Climate-related physical risk definitions

Our processes for identifying climate-related risks and opportunities

To better understand the impact of climate change on our business we used climate scenario analysis to identify climate-related physical and transitional risks and opportunities.

To help us assess our physical risks we engaged specialist consultants and used their expertise in climate modelling. We have assessed our potential exposure to chronic and acute physical climate risks at our major manufacturing and stock holding sites, considering various warming scenarios and timescales1. We have also performed the same climate modelling exercise for 130 of our suppliers.

We have disclosed the physical risks to our sites and suppliers that our climate modelling has identified us as having ‘high' exposure.

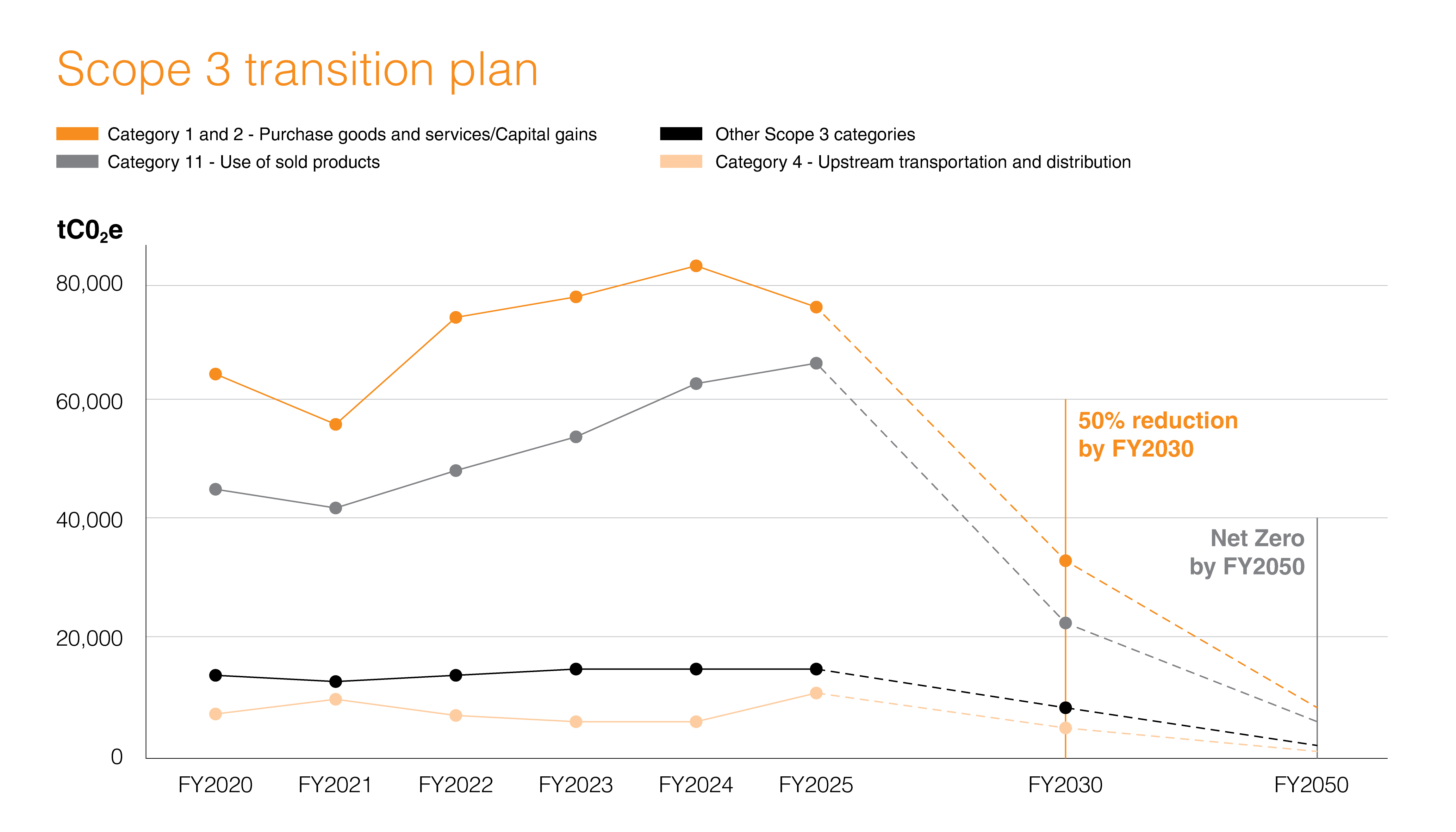

For assessing our climate-related transitional risks and opportunities, we have completed in-house assessments with all our product divisions and our regional teams. Participants in these assessments identified risks and opportunities that could impact our business. They also reviewed climate-related risks and opportunities our major customers disclose. These risks and opportunities were analysed further using a 1.5oc warming pathway2 to assess the potential likelihood and the financial/strategic impact across the short (2023 – 2030), medium (2030) and long (2050) term. Detailed below are the transitional risks and opportunities we believe could be associated with at least 3% of our potential revenue in 20303.

Climate-related physical risk definitions

1To assess physical risk, Willis Tower Watson's Climate Diagnostic Tool assesses present day and future exposure to a range of extreme (acute) weather-related events as well as chronic climate-related hazards. The selected scenarios for the physical risk assessment were based on Representative Concentration Pathways RCP2.6 (1.5oc), RCP4.5 (2-3oc) and RCP8.5 (4oc) using modified climate risk models to simulate future climate under 2030, 2050 and 2100 time horizons.

2Asset value includes i) land and buildings (with buildings included at insured reinstatement value), ii) other fixed assets (at net book value), iii) inventory (at Group cost), at 31 March 2023.

31.5 ºC warming pathway scenarios: The assessed climate-related trends were generated using the peer-reviewed International Energy Agency (IEA) “Net Zero by 2050 – A Roadmap for the Global Energy Sector” report and the 1.5 ºC aligned targets our major customers have committed to.